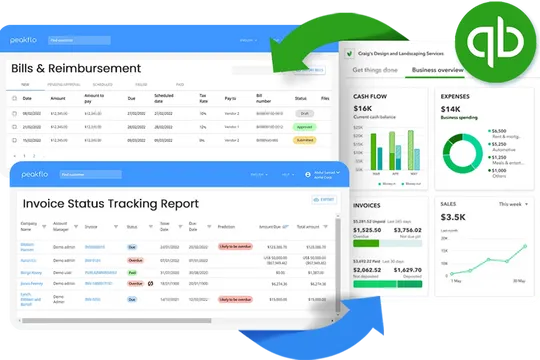

Peakflo - QuickBooks Automation

for Accounts Payable & Receivable

Empower your company’s stakeholders with secure role-based access controls. Seamlessly Integrate your QuickBooks accounting software with Peakflo to automate all your invoice-to-cash and procure-to-pay processes.

Trusted by 100+ Finance Teams

What you can achieve by integrating Peakflo and QuickBooks Accounting Software:

1000+

man-hours per month saved by automating receivable processes.

10-20

Days reduction in DSO

50%

Reduction in invoice payment time

Why Use Peakflo + QuickBooks to Automate Your Finance Operations?

Without Peakflo

Accounts Payable

Manual Procurement

Employees create purchase requisitions through Google Forms and email. The procurement team manually converts PRs to PQs and contacts vendors individually, then manually turns PQs into POs and sends them. PO issues are often missed due to the finance team’s lack of vendor communication access.

Manual Data Entry

Finance teams manually enter bills and supporting documents like shipping lists into their accounting software, spreadsheets, or templates, which often results in costly inaccuracies.

Manual PO Matching

Your AP team manually cross-checks purchase orders, invoices, and receiving documents. This process is time-consuming and prone to errors as it requires manual comparison to verify quantities, prices, and details across documents.

Manual Approvals

AP teams spend extensive hours chasing approvers through long email chains and decentralized delaying approvals when notifications are missed and preventing focus on higher-priority tasks.

Manual Vendor Payments

Manual payouts require finance teams to gather payment details, verify amounts, and process transactions through bank portals or checks, an effort-intensive process that involves chasing approvals through lengthy email chains, leading to delays and potential errors.

Inefficient Vendor Communications

Finance or procurement teams must repeatedly collect personal information and payment preferences from vendors. Each time there's an update on a PO or payment status, they must reach out again, complicating communications.

Siloed Internal Coordination

Fragmented communication within the finance team leads to delays in resolving billing issues, hindering efficient problem-solving.

Manual Reconciliation

The finance team manually audits transactions, with reconciliation taking up to 30 working days, causing inefficiencies and delays.

Lack of Control over Budgets and Spending

Departments track and manage budgets in separate spreadsheets, leading to inefficient, delayed reports and limited visibility into month-to-month spending for the finance team.

Manual Ledger Maintenance

Accountants spend significant time manually updating each transaction in the ledger, which consumes valuable time and fails to provide meaningful insights into the company's cash flow.

No Portal for Vendors

Vendors must manually check each PO and issue invoices, leading to mismatches in prices and quantities. Communications are scattered, and there’s no centralized visibility into payment statuses.

Accounts Receivable

Manual Payment Reminders

AR manager creates and sends manual payment reminders one by one, and manages invoice payment status on spreadsheets

Ineffective Customer Management

Account managers spend excessive time chasing different customers for follow-ups and managing disputes, often losing track of invoice changes and scattered communications. This leads to prolonged collection cycles and reduced team productivity.

Cumbersome Payment Process

Customers make payments to various bank accounts, requiring the AR manager to verify each payment individually, preventing automatic balance updates. The finance team must also handle disputes manually, which hampers productivity and efficiency

Manual Reconciliation

The AR manager manually reconciles each vendor payment, resolving any discrepancies with the finance team. This process can take up to a month to complete.

Manual Collections Tracking

AR managers, sales reps, and finance officers track payment statuses in spreadsheets, leading to siloed communication and delays.

Basic Financial Reporting

The finance manager manually creates detailed reports using spreadsheets to monitor customer credit limits and payment behavior, with no access to cash flow forecasts.

Manual Cash Application

Your AR team needs to manually match and apply incoming payments from customers to their corresponding invoices. This requires reviewing payment details, remittance information, and customer accounts manually which is error prone and time-consuming

With Peakflo

Accounts Payable

Centralized Procurement

Employees create purchase requisitions in a centralized platform. Once approved, PRs are seamlessly converted to purchase quotes (PQs) and sent to multiple vendors simultaneously. Approved PQs are then transformed into purchase orders (POs) with a single click and automatically shared with vendors.

AI-powered Invoice Capture

AI-powered invoice OCR automatically captures every invoice detail with unlimited custom fields, while seamlessly organizing invoices and supporting documents in 41 languages

AI-powered PO matching

Automate bill-to-purchase order matching using AI-powered OCR. Peakflo automatically matches all the line item details of your purchase orders, bills, and receipt notes and flags discrepancies. Your AP team can easily resolve discrepancies by communicating with vendors using Peakflo.

Automated Approvals

With smart approval workflow automation, Your AP team can simplify complex approval processes using flexible rules-based routing that adapts to any business requirement.

Automated Payments

By setting up a dedicated AP wallet, all the approved bills will be scheduled for payment based on the scheduled date. The vendors will receive the payment receipts automatically and the transaction will get synced into QuickBooks

Streamlined Vendor Communications

Vendors with roles-based permissions can access Peakflo’s intuitive vendor onboarding dashboard to securely update their personal details, add payment preferences, and check the status of their invoice payments—all in one place.

Teamwork Made Easy

Peakflo centralizes communications in a single platform, allowing the finance team to tag colleagues on specific bills for smooth collaboration and faster issue resolution.

Automated Reconciliation

Peakflo syncs seamlessly with QuickBooks, automatically updating scheduled and paid bills, enabling the finance team to complete account reconciliations in just 15 minutes.

Real-Time Budget and Spending Tracking

Departments can track budgets in real-time and receive alerts before they reach their limits. The finance team gains full visibility over monthly spending, enabling more informed financial decisions.

Instant Ledger Reports

Accountants can quickly review and verify transactions with real-time, automated ledger reports, helping optimize cash flow management and financial accuracy.

Vendor Portal

Vendors can view all their PO statuses and details in one centralized portal, without being able to edit prices. They can issue invoices with a single click, while all communications are centralized and payment statuses are easily accessible.

Accounts Receivable

Automated Payment Reminders

With smart reminder workflows, AR teams can automate sending multi-channel reminders to different segments of customers based on payment behavior with pre-filled reminder details.

Finance CRM

Account managers can easily create and manage tasks, track customer responses, resolve disputes, and stay on top of pending and upcoming tasks. They can make calls, send multi-channel follow-ups, and respond to customers—all while Peakflo automatically records every communication and detail in a clear, centralized timeline.

Streamlined Payment Process

Peakflo's self-serve customer portal allows customers to make payments and raise disputes quickly. The finance team receives payments directly into their bank account and can manually enter off-platform payments, with balances automatically updated for seamless reconciliation.

Instant reconciliation

Finance teams can save up to 100 man-hours by using static and dynamic virtual accounts, enabling instant reconciliation and streamlining the process.

Real-Time Collections Tracking

All stakeholders can track invoice and payment statuses in real-time within an interactive workspace, ensuring seamless communication and up-to-date visibility.

AI-powered Reports & Predictions

The finance team gains access to detailed reports, predictive cash flow analytics, and credit control insights, along with customer payment status and behavior, to enhance decision-making and optimize collection strategies.

AI-Powered Cash Application

Peakflo's AI-powered remittance extraction automatically extracts the payment details and auto-matches the payment based on the remittance payment reference number. Peakflo AI can automatically identify and apply exception rules for discounts and taxes. Set up workflows for unapplied payment reminders, and let customers review and apply payments to invoices with one click.

Success Stories

Ninja Van

Ninja Van issues 10,000 invoices per month to customers with different requirements. Before Peakflo, Ninja Van needs to prepare the invoices manually. Not to mention the effort needed to follow up and resolve disputes. With Peakflo and Netsuite 2-Way-Sync, NinjaVan is able to issue custom invoicing smoother based on specific field mapping. The customer portal also centralizes communication and dispute management with customers.

NRI

Before Peakflo, vendors manually submitted invoices in hard copy to NRI’s client. The Procurement team had to check if the received supporting documents or invoices are correct. Then, The Accounting (AP) team would recheck the invoice and input the details already processed by the Procurement team. For new vendors, the Procurement team would input the invoice using a template, and the approvers would manually validate and verify the purchase order details. This entire process was time-consuming for the procurement and AP team.

Haisia

Before Peakflo, every department in Hai Sia had to submit reimbursements and bills for approval via email or hardcopy documents. Approvals is also very hard to track. With Peakflo WhatsApp OCR, Hai Sia team need to only take a picture of the bill and send it to WhatsApp, and the bill entry gets automated. On top of it, Hai Sia team can track approvals, payments and vendor communication seamlessly in one place.

InMobi

Before Peakflo, InMobi AR team had to create invoices manually with many customizations unique to different regions across the globe. Now, with Peakflo, InMobi can create GST tax invoices with high customization, like HSN/ SAC code, QR code, GSTIN, and e-signatures. Following up on unpaid invoices also made easy with real-time reports.

EverPlate

EverPlate’s operational team, coming from a non-finance background, had a difficult time issuing invoices and tracking payments, resulting in incredibly tight cash flows and wasted man-hours spent doing repetitive tasks. With Peakflo's centralized dashboard, Everplate is able to track invoice status accurately and make customized multi-channel payment reminders

Gazzda

Before Peakflo, Gazzda team had to manually send follow-up emails for 300 invoices per month. Gazzda team also had a hard time doing manual data entry for vendor invoices received by paper and track their status. With Peakflo, Gazzda can automate payment reminders. The scattered vendor invoice management became centralized and the vendor invoice processing has gotten much faster and easier.

Rey

Before Peakflo, manual bill approvals could take days and budget management could take a full month for the finance and other divisions in Rey. With Peakflo, Rey can now automate complex approval with the approval workflow. All bills and payments are assigned to a budget automatically and recorded in a structured manner, so the team wouldn’t spend so many hours doing budget recap.

Janio

Before Peakflo, Janio didn’t have any visibility into their collections process, making it challenging to plan their budgets. They also need to follow-up manually on 5,000 invoices/month. With Peakflo’s customer status tracking report, Janio is able to see customers’ payment behavior and timeline. The automated reminder workflow also remove the needs to manually follow-up on customer payments.

Pickupp

Before Peakflo, Pickupp had a manual process for collecting and monitoring outstanding payments. This manual approach has led to data silos in communications. With Peakflo easy-to-use interface, monitoring and collecting outstanding payments is very easy. As a result, Pickupp reduced monthly overdue by 40% and DSO by 25%.

EstimateOne

EstimateOne’s three-women financial team had a tough time recording payment status in spreadsheets – which didn’t provide them much visibility on overdue invoices. With Peakflo reports and real-time tracking, EstimateOne was able to gain more insights into customers’ invoice status through the comprehensive reports, making collection much easier and faster.

Glints

Before Peakflo, Glints team had to sent invoice reminders one by one manually from their accounting software. The process of sending and personalizing took around a full day. With Peakflo’s automated workflows, now Glints team automatically sends all the invoice reminders through emails to their customers and reduce DSO.

Aris Infra

ArisInfra’s collections team sent email reminders manually and it took a five-person team to handle all these follow ups. With Peakflo’s automated workflows, now ArisInfra’s finance team automatically sends all the invoice reminders through emails. Now, just one person checks on the automated reminders and tracking customer payments

We Interactive

WE! Interactive, as a Xero accounting software user, needs to send reminders that were sent out one at a time and only through email. With Peakflo’s automated workflows, now We! Interactive accounting team automatically sends all the invoice reminders through email to their customers.

Advance

Before using Peakflo, Advance used Google sheets to send around 500 invoices and send manual email reminders to their customers. It took around half a day every day. With Peakflo automated workflows, now Advance finance team automatically sends all the invoice reminders through emails to their customers and their team is able to focus on more value-added tasks.

Driver Logistics

The Peakflo team was very efficient in understanding our requirements, and they developed customized solutions to make the day-to-day finance operations much more effortless. We’ve been able to reduce our average overdue days by 16 and increase our receivable efficiency by 35%.

Bharathi Homes

Peakflo’s customizable approval automation has been highly beneficial for our team, We’ve been able to save 200 man-hours per month. We have also automated manual tasks such as PO creation and 2-way matching and increased efficiency by 74%.

My Robin

Before Peakflo, the approvals were done using emails, and MyRobin’s finance team attempted to use Excel to track the approvals. Lack of approval workflow automation resulted in too much time being spent on manually chasing approvers and Excel did not provide any visibility over the audit trail for the team.

Vida

Peakflo approval workflows have been a great help for streamlining our purchase order and bill approvals. We’ve been able to save 20,254 man hours with Peakflo. We also no longer need to create reports manually and have saved 16 man hours by using Peakflo's out-of-the-box AP reports.

Construction Machinery

Before Peakflo, our client used Excel sheets and other tools for creating and managing their purchase orders and bills. The entire process was not centralized and the AP team had to spend many hours using different platforms for their invoice processing.

Law Firm

In Xero accounting software, the reminders are not supported to have workflows and cannot be sent to specific customer segments in one go. Therefore, the biggest pain point for our client’s finance team was to send all the reminders and follow-ups manually and spend hours on crafting the right messages.

Check out QuickBooks + Peakflo Integrations on Peakflo Help Portal!

Learn More